Position statements

Risk management

We use a framework to manage the risks that could occur in our business. This ensures that we identify and understand risks, assess them properly and deal with them effectively.

We have tailored our risk management to enable our business objectives to be achieved by balancing risks and opportunities. At the same time, we’re committed to meeting our obligations to our people and the societies in which we operate.

We want to make our people aware of risk. But we also want to encourage a more entrepreneurial attitude towards the opportunities and rewards that can come out of it.

More specifically, our risk management framework gives us:

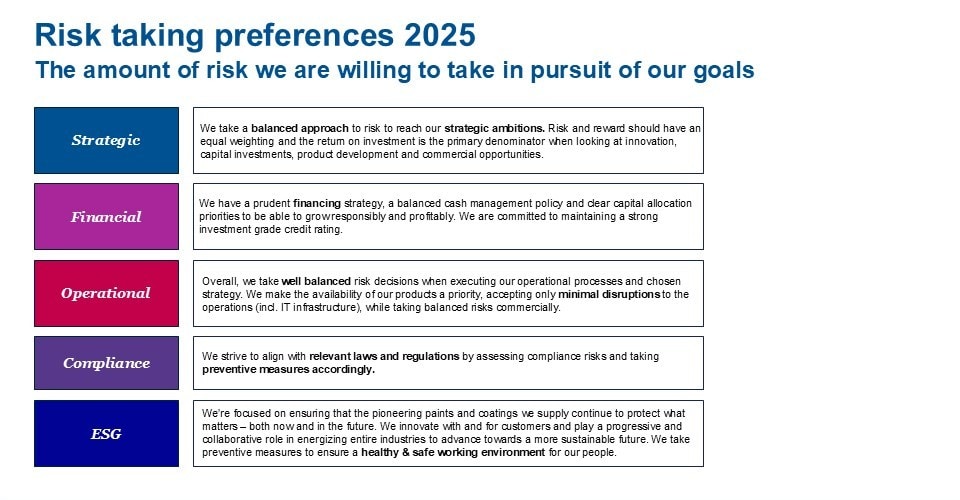

Risk appetite

We believe we must operate within the dynamics of the paints and coatings industry and take the risks needed to ensure our relevance in the market. At the same time, topics related to our core values and company purpose require a different risk appetite. Please find below our current risk appetite.