Results Center

"2024 was a year of solid organic growth for AkzoNobel as we demonstrated our ability to grow in mixed market conditions. We faced a complex operating environment, with continued inflationary pressure, adverse currency impacts and unstable markets. Although these headwinds spurred competitive intensity and tested our resilience, they also strengthened our determination to control our own destiny by stepping up self-help measures that ultimately boosted our performance."

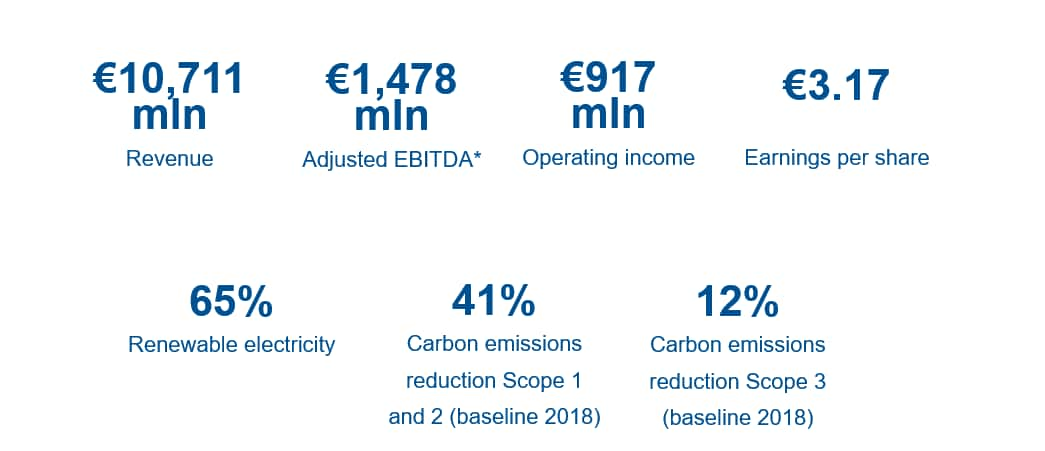

*Alternative Performance Measures (APMs). AkzoNobel uses APM adjustments to the IFRS measures to provide supplementary information on the reporting of the underlying developments of the business. APMs include, but are not limited to, adjusted operating income, (adjusted) EBITDA, adjusted earnings per share, ROS and ROI. A reconciliation of the Alternative Performance Measures to the most directly comparable IFRS measures can be found in Note 3 of the Consolidated financial statements in our Report 2024.

We have a long history of transparent reporting with regard to our environmental, social and governance (ESG) performance, which is included every year in our annual report. Accurate and robust data on our sustainability performance helps us make decisions, monitor performance and report progress to our stakeholders. The Sustainability section in our Report 2024 has been expanded to align with the requirements of the Corporate Sustainability Reporting Directive (CSRD).

Please feel free to contact the team at:

The annual report presented on this website, including the PDF version, is derived from the official version of the company’s Report 2024. The European Single Electronic Filing format (the ESEF reporting package) is the official version. The ESEF reporting package is available above. In case of any discrepancies between the website, the PDF version and the ESEF reporting package, the latter prevails. The auditor’s report and assurance report of the independent auditor included in the PDF version on this website relate only to the ESEF reporting package.